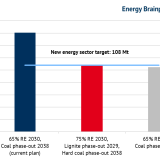

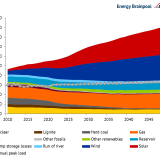

An early coal phase-out, 80 percent renewable energies by 2030, and climate neutrality by 2045: These are the three energy industry cornerstones of the German government’s ambitious plans in the coalition agreement. Implementing the contents of two legislative packages is on the agenda this year.

Continue reading