Carbon prices may see the competitiveness of ground-mounted solar power overtake coal in China, show projections by the International Energy Agency (IEA). Article by Gerard Wynn republished with permission from “The Energy and Carbon Blog”.

As Gerard Wynn writes at the “The Energy and Carbon Blog” in his article, China has introduced seven pilot carbon markets, and plans a national cap and trade scheme before 2020. The average carbon price in the seven pilot schemes is presently around $5-7 per tonne of carbon dioxide (CO2) emitted. The country has not published indicative carbon prices it expects under a national scheme.

Emissions trading schemes force polluters to pay a charge per tonne of CO2 emissions.

The new IEA study analysed electricity generation costs across a range of power plan technologies globally, to be commissioned in 2020.

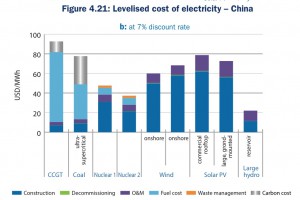

The IEA’s core measure of cost was the levelised cost of electricity (LCOE), which calculates the cost of electricity generation over the lifetime of a power plant (40 years for coal, 25 years for solar PV).

The study assumed an indicative $30 carbon price. At such a high carbon price, the IEA found that commercial roof-top and ground-mounted solar would be about the same cost or cheaper than coal in China by 2020 (see figure below).

While there appears little doubt over China’s commitment to emissions trading, there is no prospect of a $30 carbon price in 2020, but prices could reach such levels in the 2020s.

In detail, the IEA calculated that for a central discount rate estimate (7%), the LCOE of coal was $78 per megawatt hour (MWh), compared with $73 for ground-mounted solar and $79 for commercial roof-top.

The IEA did not publish a detailed sensitivity analysis for LCOEs for lower levels of carbon price, but did report that tripling the carbon price resulted in an approximately 53% increase in the LCOE for coal, with the implication Chinese coal power costs would be $51/ MWh at a $10 carbon price.

That suggested unsubsidised, ground-mounted solar power would break even with coal-fired power at a carbon price of around $25. Such growing competitiveness of solar may add to downward pressure on demand for coal, at present suffering from China’s economic slowdown and its growing crackdown on air pollution, after the deadly smog in the winter of 2013, dubbed “airpocalypse”.

Note – The Figure is taken from the IEA report; terms and conditions of use and copyright of IEA publications are at the following link: http://www.iea.org/t&c/termsandconditions/