Thüga, the German network for local and regional energy suppliers, estimates that profits from trading activities for German utilities will decline by 75 percent until 2024.

In a joint study with AT Kearney, the biggest German holding for municipal works, calculated that total earnings of energy providers will decline by 21 percent to EUR 15.6 billion from 2011 to 2024. According to Thüga, the sharpest decline in profits will become obvious in the generation and the trading sector. The former will shrink from EUR 8 billion to EUR 3.8 billion, the latter from EUR 2.8 billion to EUR 0.7 billion.

Both business areas suffer especially from fewer operating hours for conventional thermal power plants and declining wholesale prices for electricity, both of which are further fueled by the expansion of renewable energy capacity. According to the study, decentralized generation is the only business area that benefits and can reap higher profits in the future. The profits are projected to rise from EUR 1.9 billion auf EUR 4.9 billion. However, the study points out that most of these decentral power plants are renewables and owned by private investors and not the traditional utilities.

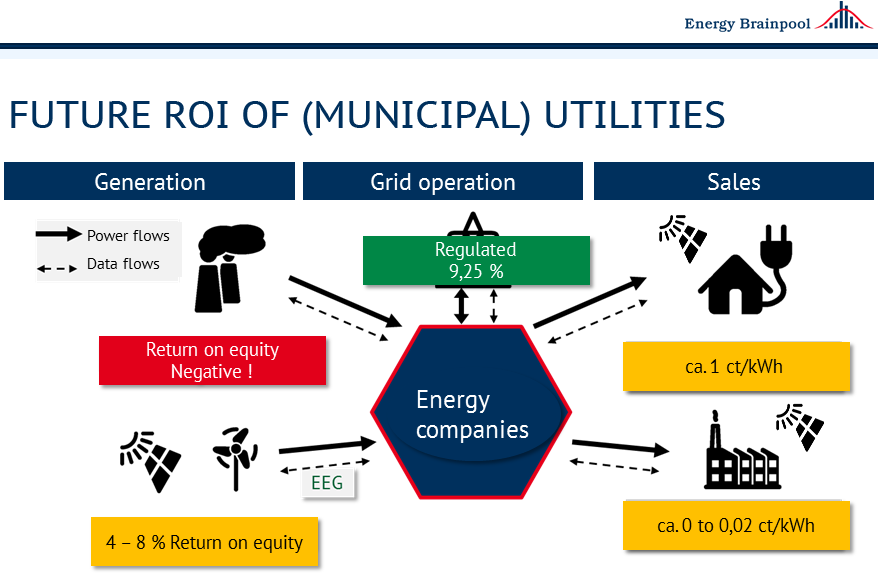

Current estimates by EnergyBrainpool for return on equity of different business areas of energy companies in the future are shown in figure 1. Conventional generation might deliver negative returns, while the regulated areas of renewable energy generation and grid operation, as well as part of sales are able to generate positive returns on equity.

Figure 1: Return on equity for energy companies (Estimates)

The energy sector faces profound challenges. Smaller margins in the trading sector result even though the number of transaction is bound to rise due to increasingly fluctuating power prices. Processes will be more detailed and complex, where digitalization of the energy sector is able aid in steering those processes.