Conventional power plants suffer from low spot market prices. When capacity leaves the market, the remaining power plants might however see higher margins again.

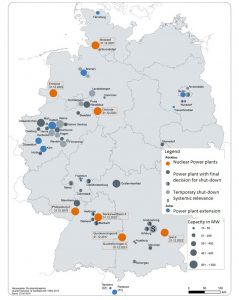

The German regulator published its new figures on planned power plant closures. Power plant operators have reported more than 6.5 GW of conventional capacity to be closed-down by 2020. Factoring in the capacity under construction, this would lead to a net decline of conventional capacity of 2.8 GW by the end of the decade. Most of power plants to be shut down are located in Southern Germany, where net capacity could decrease by 2.3 GW (Source: Montel). The largest part of that is due to the closure of two big nuclear power plants. Southern Germany is however a load center and unless transmission lines from the windy north to south are constructed in time, this capacity reduction might prove cumbersome.

In total, Germany has 204 GW of installed capacity, 98 of which is from renewable sources, mainly onshore wind and PV. However, with 49 GW coal-fired power plants still make up the largest power plant capacity (Source: Montel).

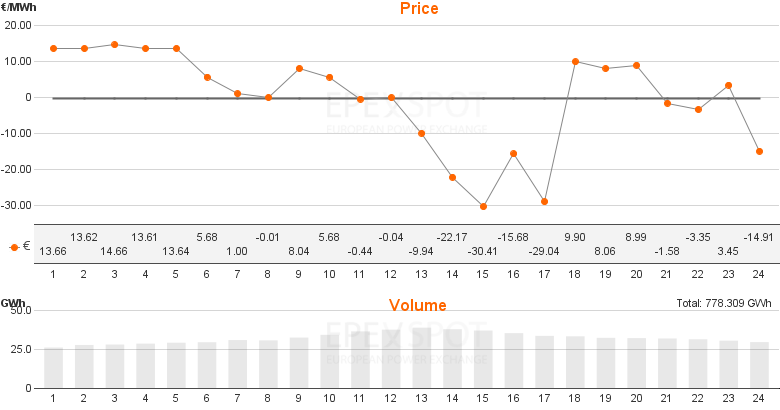

Conventional power plants struggle with low margins due to lower power prices. During Sunday, 20th of November 2016 the Day-Ahead base load price settled slightly in the negative (Figure 1), as the combined generation of wind and solar peaked at more than 40 GW. In 11 hours of Sunday power prices have settled below EUR 0. While the lowest price for one hour in the day-ahead auction has been -30.41 EUR/MWh, the prices on the Intraday market went down to -176.7 EUR/MWh (Source: Montel). With a feed-in of more than 30 GW of wind and low demand, those prices do not come as a surprise. With further renewable capacity additions this phenomenon will occur even more often.

Figure 1: Day-ahead prices for power in Germany on Sunday 20.11.2016 (source: Epex)

This puts conventional power plant operators in a dilemma. Either they keep their power plants online and have low or even negative returns, or they shut them down not earning any money with them anymore. In the latter case the operators that kept their plants running, will then profit from reduced conventional capacity thus higher spot prices. The operators that can accept accepting lower margins for a longer period of time will thus have advantages over less financially apt competitors in the long run.