On the 20th of May 2015 the Flow Based Market Coupling has finally started after eight year of preparation. The more efficient allocation of cross border capacities will increase the international electricity exchange and will have an effect on electricity prices.

After eight year of preparation and after two years of an intensive testing period the more efficient allocation of the cross border capacities in the Central Western European Market system (Germany, France, Belgium, The Netherlands and Austria) has started.

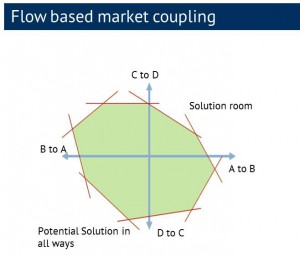

With the Flow Based Market Coupling, the cross border capacities for import and export will be allocated depending on the status of the electricity grid. The status of the grid is depending on the feed in of fluctuating renewables. Their changes are effecting the grid flow which will be limited in the case we do allocate fix cross border capacities.

Market participants do expect and effect on electricity prices. Especially Germany with a high feed-in of renewables can benefit with higher export volumes, but this will lead to higher prices. Analysts from Energy Brainpool do expect higher prices for Germany at a level round about 1 EUR/MWh. However for Belgium lower electricity prices are expected, which could lead to falling prices of 2.30 EUR/MWh.

Other analysts are expecting higher price effects up to 1.5 EUR/MWh for Germany. For the refinancing of renewables there price changes are good news, because especially in those hours, where high wind energy volumes are expected the prices will increase accordingly, which will lead to a positive support of the EEG account.