While the big step towards competition in China’s power market did not materialize yet, the big Chinese power generators have to accomodate sinking power generation.

Article sources with kind recommendations of the Sino-German Energy Partnership of GIZ on behalf of the Federal Ministry for Economic Affairs and Energy (BMWi).

Since almost 20 years the Chinese energy market is under reform, with only moderate steps towards a complete liberalization. The goals of the power market reform are to provide power to customers based on market mechanisms and with stable prices, higher environmental standards, as well as an opening-up of the existing system for private companies and providers. However, State Grid Corporation with roughly 1.1 billion customers holds a monopoly in the power market in most parts of the country.

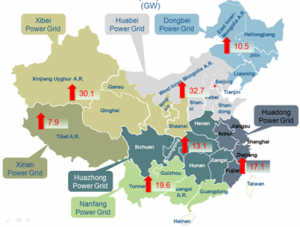

Real progress has however been achieved in the creation of power trading platforms aimed at introducing competition at least between generators. Pilot projects are being conducted in all Chinese provinces. Framework conditions and the market design of the platforms and available products in the different provinces vary however considerably. Thus, the main effect of the trading platforms has been the creation of provincial power markets and trading, while a country-spanning power market cannot be discerned as of now.

Guizhou trading platform (source: Azure International)

Still, four of the five biggest Chinese power companies have noted reduction in generation during the past six months. The decline in production for China Huaneng Group has been 5.9 percent year-on-year. Until the end of June 2016, the company just generated 188.7 TWh. Similarly, China Datan, China Guodian and China Huodian suffered a decrease in the volume of the power they generated by 4.11, 2.01 and 1.54 percent.

At the same time the Chinese government reduced the state-regulated power prices for generators, especially those from coal, in order to replace electricity from coal by electricity from nuclear power plants and renewable energies. The average compensation for Huaneng slumped by 12.37 percent to 394.36 RMB/MWh (52.56 EUR/MWh) compared to 2015.